National consumer credit protection

Overview National consumer credit protection

Under the National Consumer Credit Protection Act 2009 (Cth), credit licensees have a duty to comply with responsible lending provisions. These provisions protect both consumers and credit providers by minimising risks on both sides of the relationship.

You may also like our comprehensive course The NCCP Act and Responsible Lending RG209

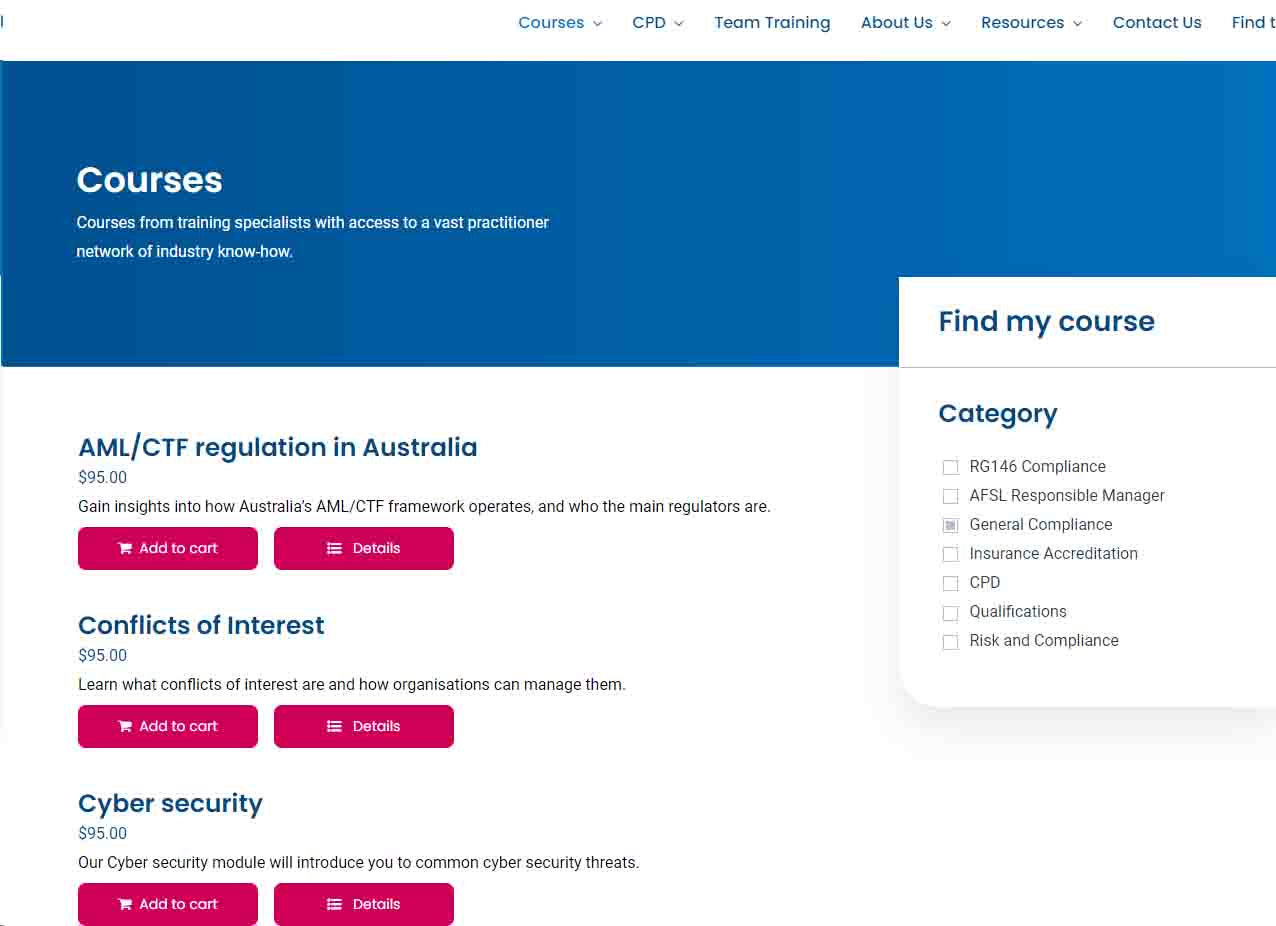

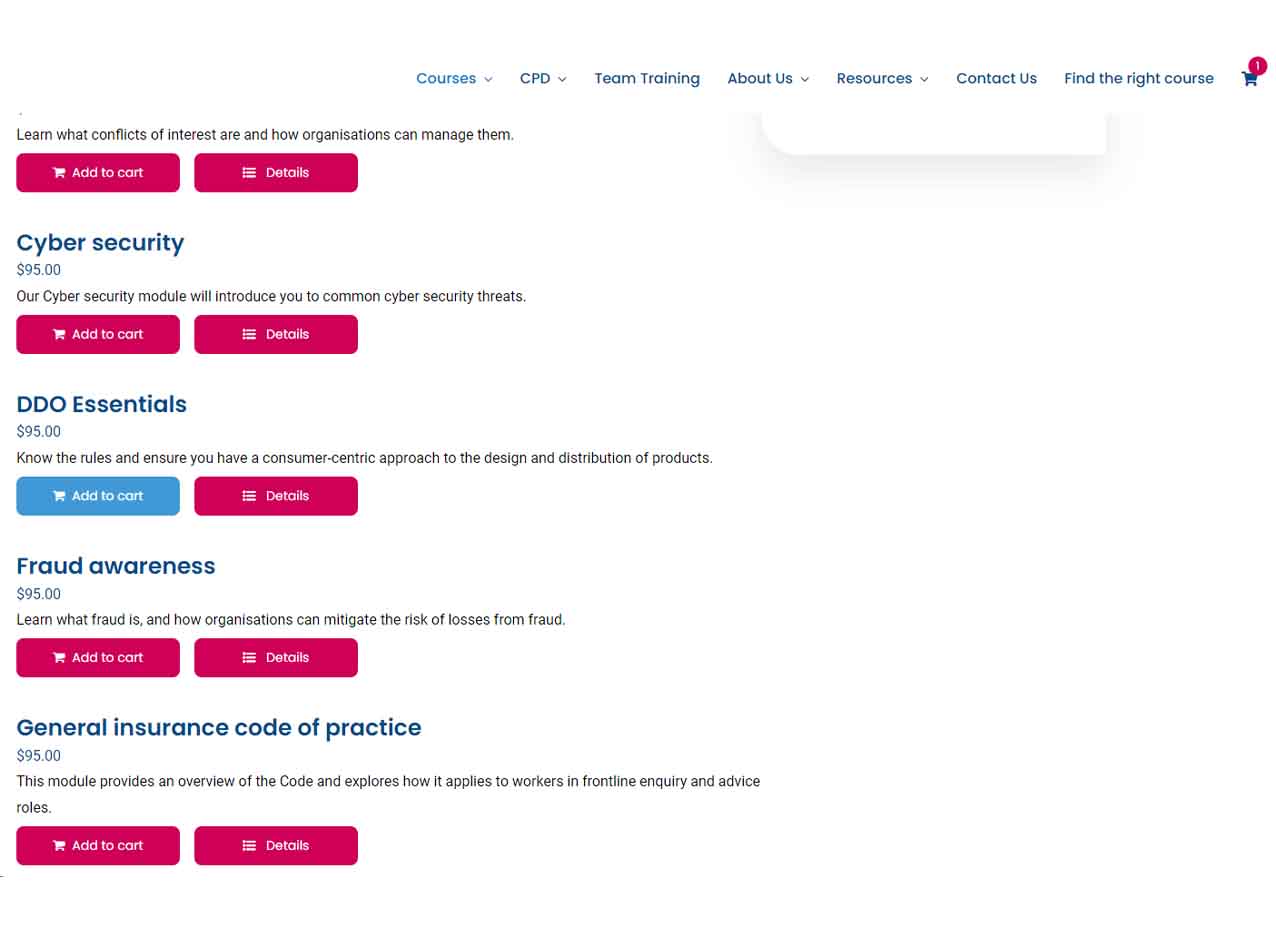

Regulatory compliance and conduct learning

Our General Corporate Compliance modules are designed for enterprise wide training, offering bite-sized modules (30-45 minutes), the perfect study duration, balancing convenience with learning. Contextualised specifically for Financial Services.

About our National consumer credit protection module

In this module, you’ll learn about your organisation’s responsibilities, and the conduct and processes you need to follow to meet these provisions.

Program Content

- What is responsible lending?

- Applying the responsible lending provisions (RLOs)

- Providing disclosure documents.

Learning Outcomes

- Outline the responsible lending provisions

- Describe the steps involved in meeting responsible lending obligations

- Demonstrate when and how the provisions apply in your organisation

- Explain the prescribed disclosure documents you may need to provide customers.

What you will learn

Who is this course for?

- Any financial representatives who must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Units of Competency