General Corporate Compliance Training

General Corporate Compliance

A simple enterprise-wide solution for a complex world of regulation.

Effective compliance training is learning that is engaging, relevant and meaningful for organisations and their employees.

Our Corporate Compliance modules are suitable for organisation wide training from front-line employees to management and leadership and directors.

- Licensees must comply with general obligations under various Acts, including the Corporations Act.

- All financial representatives must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Licensees are also required to be able to provide evidence to regulators that their representatives are adequately trained to perform their role on both an initial and ongoing basis.

(RG 104 AFS licensing: Meeting the general obligations, RG 205 Credit licensing: General conduct obligations).

Tailor your learning journey

Select specific modules your team requires allowing you to focus on just the areas that matter most.

Effective, meaningful training

Engaging modules, helping learners to efficiently process, retain, and apply information.

Flexible delivery

Online via our LMS or SCORM files hosted on your LMS. Customisable to your organisation’s policies and procedures.

Fits easily into busy workdays

Each module is 30-45 mins. The perfect study duration, balancing convenience with learning.

Frequently Asked Questions

Corporate Solutions

Request a quote for your team.

OR

Purchase online: Three easy steps to get your team started.

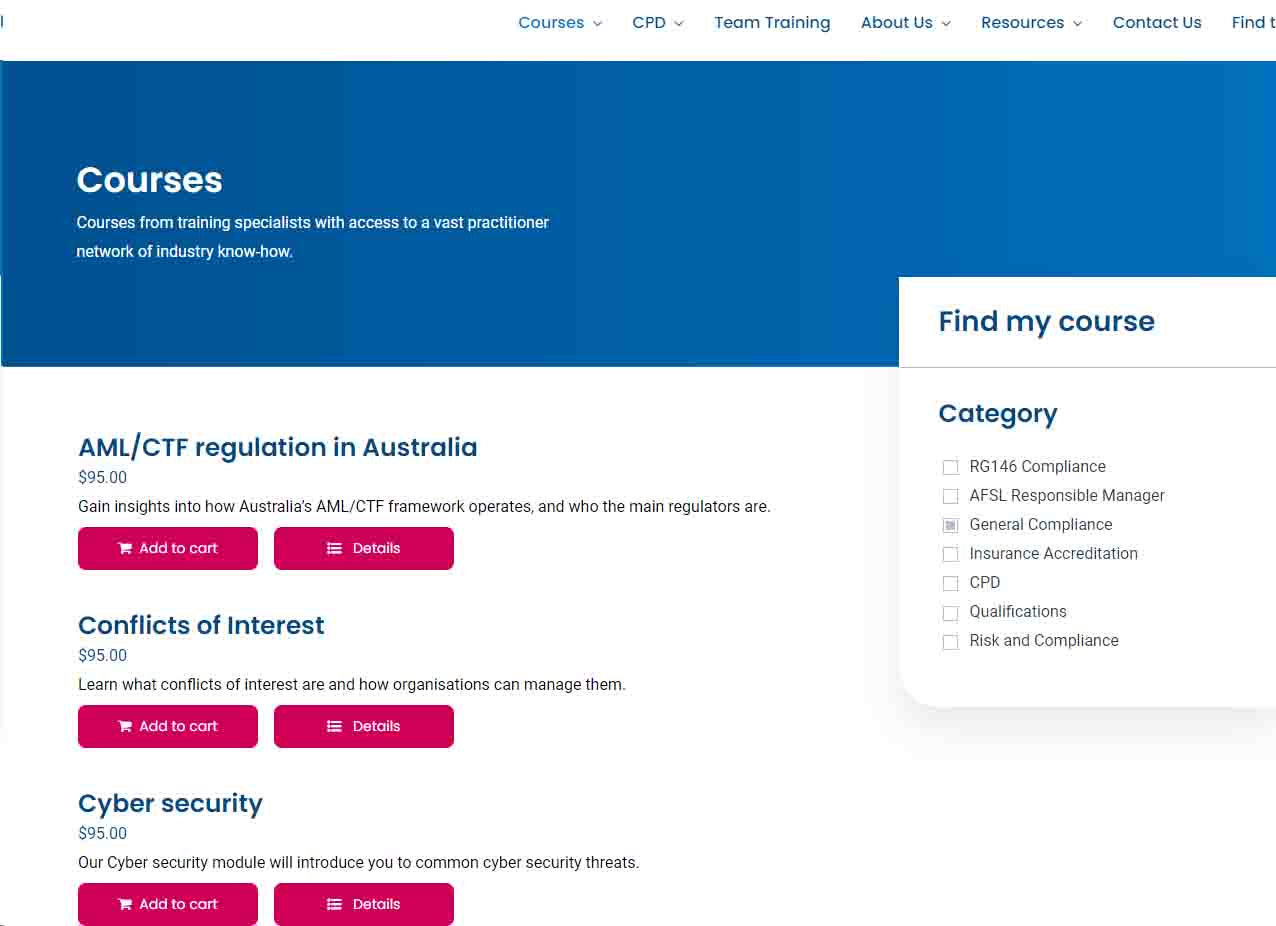

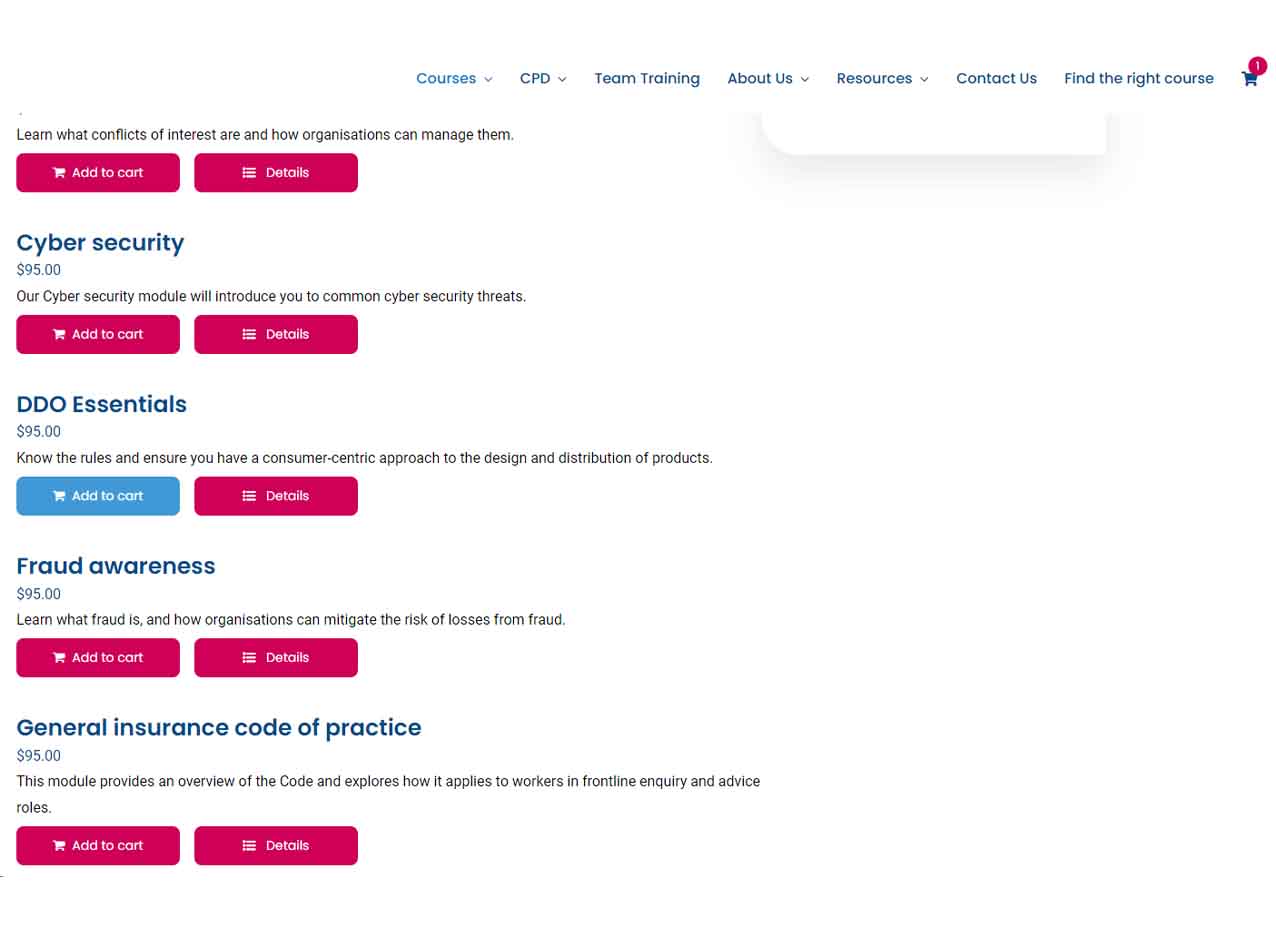

- Visit our Shop Page and select General Compliance

- Select your courses to meet you and your team’s general obligations

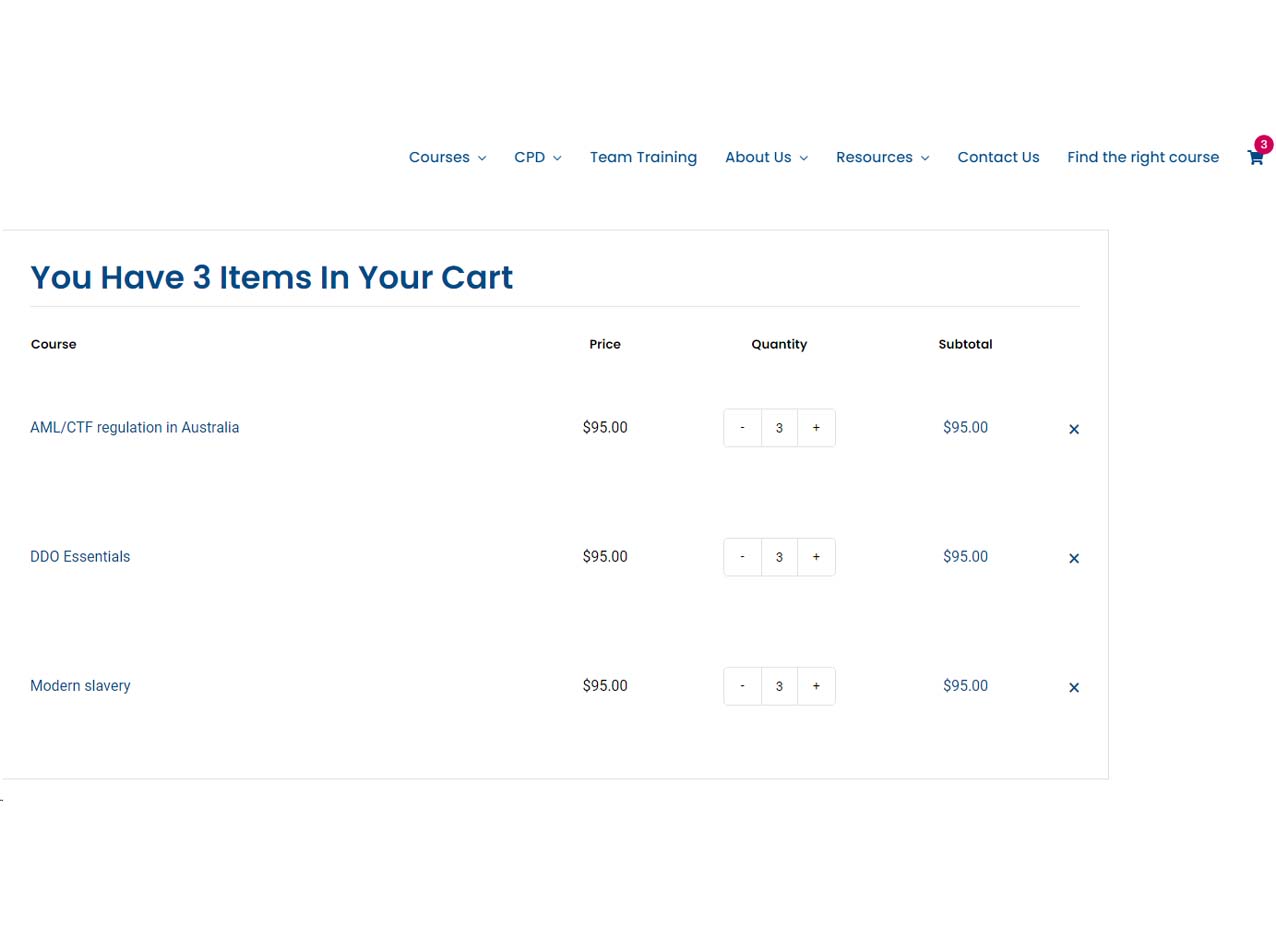

- Add the required number of courses to your cart

We will request participants name and email. Once confirmed, we will enrol your team and they can begin their training.

Our general corporate compliance training contains a suite of engaging online modules designed to make employees aware of their responsibilities and feel empowered to uphold the conduct and regulatory standards applicable to their organisation.

A general compliance module – refers to a corporate e-learning course designed to meet specified organisational, legislative and/or conduct requirements.

The team at FEP understands that effective compliance training is not just about delivering regulatory content; it’s about creating learning that is engaging, relevant and impactful for organisations and their employees.

We design training experiences that resonate with individuals, ensuring they gain practical knowledge and skills that are immediately applicable to their roles.

Regulatory News

-

23 October 2025

ASIC Chair to release markets roadmap at National Press Club

23 October 2025ASIC Chair Joe Longo will make an address titled ‘Open for opportunity: Taking charge of the future of our financial markets’ at the National Press Club in Canberra on 5 November. The address will unveil ASIC’s roadmap for strong, efficient and globally competitive public and private markets, including detail of regulation for future-fit markets designed to attract capital, create wealth, and dodge potential disasters.

View ASIC WebsiteASIC Chair to release markets roadmap at National Press Club

ASIC Chair Joe Longo will make an address titled ‘Open... -

23 October 2025

APRA proposes more accessible pathway to IRB accreditation for banks

23 October 2025The Australian Prudential Regulation Authority (APRA) has proposed a simpler, clearer and more streamlined pathway for banks to become accredited to use the internal ratings-based (IRB) approach to calculating credit risk-weighted assets.

The IRB method is one of two approaches banks can use to calculate risk-weighted assets, which determines the amount of regulatory capital they need to hold for credit risk.

While the vast majority of banks use the standardised approach, APRA has approved six of the largest banks to use the IRB approach.

The IRB approach can provide a small financial benefit to banks by marginally reducing their capital requirements. However, accreditation to use the IRB approach requires banks to demonstrate a high level of sophistication in their risk management practices that has historically been too resource-intensive for most banks to achieve.

Noting that some medium-sized banks have expressed interest in obtaining IRB accreditation, APRA is seeking to make the pathway to IRB accreditation more accessible for these banks.

In a consultation paper released today, APRA has proposed a range of changes to the IRB accreditation pathway designed to help more banks access the IRB approach.

A consultation paper outlining the proposed changes is available via the link.

View APRA WebsiteAPRA proposes more accessible pathway to IRB accreditation for banks

The Australian Prudential Regulation Authority (APRA) has proposed a simpler,... -

17 October 2025

AML/CTF reforms guidance released

17 October 2025AUSTRAC has published new reforms guidance. This marks another important step in helping you prepare for the new anti-money laundering and counter-terrorism financing (AML/CTF) laws coming into effect.

View sourceAML/CTF reforms guidance released

AUSTRAC has published new reforms guidance. This marks another important... -

16 October 2025

Improving consumer outcomes is everyone’s job

16 October 2025Keynote address by ASIC Commissioner Alan Kirkland at the Institute of Managed Account Professionals Independent Thought Conference in Sydney on 15 October 2025.

Given the ever-increasing role managed accounts are playing in Australia’s investment landscape, governance frameworks and management of conflicts of interest are among ASIC’s strategic priorities for that sector.

View ASIC WebsiteImproving consumer outcomes is everyone’s job

Keynote address by ASIC Commissioner Alan Kirkland at the Institute... -

14 October 2025

ASIC sends clear message to super trustees amid glaring retirement communications gaps

14 October 2025ASIC is concerned that many Australians may not have the information they need to make confident and informed decisions about retirement after a review identified a lack of urgency in improving retirement communications among superannuation trustees collectively responsible for millions of members.

View ASIC WebsiteASIC sends clear message to super trustees amid glaring retirement communications gaps

ASIC is concerned that many Australians may not have the... -

14 October 2025

Protecting financial futures: ASIC’s priorities in credit

14 October 2025Commissioner Alan Kirkland delivered a keynote address at Credit Law 2025 on 14 October.

Here are the highlights of Alan’s address:

- ASIC’s role is to ensure consumer credit protections are universally applied and enjoyed. That’s why ongoing work to examine compliance across the sector continues to be a priority.

- Key areas of focus include mortgage brokers, motor vehicle finance, financial hardship, debt management, credit repair and debt collection.

- ASIC continues to take action across the spectrum, wherever we see credit-related misconduct. Entities whose conduct causes harm to consumers – or harm to their financial futures – should expect ASIC to take an active interest.

Protecting financial futures: ASIC’s priorities in credit

Commissioner Alan Kirkland delivered a keynote address at Credit Law... -

13 October 2025

Reforms to support low-income workers and build a stronger super system

13 October 2025The federal government has scrapped taxing of unrealised capital gains for large super balances following consultation on measures to make the superannuation system stronger, fairer and more sustainable. While tax concessions will still be reduced for super balances over $3 million, a second threshold of $10 million will incur further reduced concessions. Among other measures, the thresholds will now be indexed and the start of changes has been delayed to 1 July 2026.

View Treasury WebsiteReforms to support low-income workers and build a stronger super system

The federal government has scrapped taxing of unrealised capital gains... -

13 October 2025

APRA launches Innovate Reconciliation Action Plan 2025-27

13 October 2025The Australian Prudential Regulation Authority (APRA) has released its Innovate Reconciliation Action Plan (RAP) for the period October 2025 to September 2027. This is APRA’s second Innovate RAP and third RAP since 2017.

The latest Reconciliation Action Plan builds on APRA’s previous commitments and focuses on four key themes:

- Creating a working environment that increasingly attracts, retains and develops Aboriginal and Torres Strait Islander employees.

- Broadening the impact of our RAP activities throughout APRA’s five offices across Australia and forming local cultural connections.

- Developing opportunities for more APRA employees to engage personally with First Nations people and cultures, growing their cultural awareness and contributing to reconciliation more directly in the broader Australian community.

- Further exploring APRA’s specific role to promote reconciliation within its sphere of influence – in partnership with other financial regulators – in a way that aligns with APRA’s mandate.

APRA launches Innovate Reconciliation Action Plan 2025-27

The Australian Prudential Regulation Authority (APRA) has released its Innovate... -

10 October 2025

ASIC Commissioner Alan Kirkland’s remarks at the Insurance Council of Australia Annual Conference

10 October 2025Rebuilding after the storm

Commissioner Alan Kirkland delivered remarks at the Insurance Council of Australia Annual Conference in Sydney on 10 October.Here are the highlights of Alan’s remarks:

- The insurance industry has an enormous task ahead to rebuild trust with the Australian community following a challenging period of claims handling failures.

- The development of a new General Insurance Code of Practice that will be enforceable by contract is an important step towards rebuilding trust. However, unless the provisions themselves improve overall levels of consumer protection, it will be a step backwards.

- Our challenge to industry over the next year is to commit to a code that will make a real difference to your customers. Simple cannot be code for stripped out.

ASIC Commissioner Alan Kirkland’s remarks at the Insurance Council of Australia Annual Conference

Rebuilding after the storm Commissioner Alan Kirkland delivered remarks at... -

10 October 2025

APRA publishes Suzanne Smith’s remarks to the ICA conference 2025

10 October 2025The Australian Prudential Regulation Authority (APRA) has published remarks delivered by Member Suzanne Smith to the 2025 Insurance Council of Australia conference in Sydney.

Under the headline “From risk to resilience: Futureproofing Australia’s insurance sector” Ms Smith addressed how the sector can prepare itself by focusing on resilience, innovation, and leadership in a world of rising risks such as climate change, cyber threats, and geopolitical instability.

She emphasised the importance of getting the basics right – strong risk management, operational resilience, and accountability – while encouraging insurers to embrace innovation and transparent customer engagement. She concluded that effective leadership and a healthy risk culture are essential for building trust and ensuring the industry remains robust and prepared for future challenges.

View APRA WebsiteAPRA publishes Suzanne Smith’s remarks to the ICA conference 2025

The Australian Prudential Regulation Authority (APRA) has published remarks delivered... -

10 October 2025

ASIC flags risks in offshore outsourcing after review identifies governance gaps

10 October 2025ASIC is calling on financial services entities to strengthen governance and risk management after a review found weaknesses in the use of offshore service providers exposing consumers and investors to potential harm.

View ASIC WebsiteASIC flags risks in offshore outsourcing after review identifies governance gaps

ASIC is calling on financial services entities to strengthen governance... -

10 October 2025

APRA publishes Chair John Lonsdale’s Opening Statement to the Senate Economics Legislation Committee

10 October 2025The Australian Prudential Regulation Authority (APRA) has published Chair John Lonsdale’s Opening Statement to the Senate Economics Legislation Committee.

View APRA WebsiteAPRA publishes Chair John Lonsdale’s Opening Statement to the Senate Economics Legislation Committee

The Australian Prudential Regulation Authority (APRA) has published Chair John... -

10 October 2025

Payday Super legislation introduced and draft PCG

10 October 2025On 9 October, the Government introduced Payday Super legislation into Parliament to take effect 1 July 2026. This measure is not yet law.

Tax professionals should be aware of how the proposed Payday Super reform may affect employer clients.

View sourcePayday Super legislation introduced and draft PCG

On 9 October, the Government introduced Payday Super legislation into Parliament to take... -

9 October 2025

Treasury consults on next phase of payments reforms

9 October 2025Treasury has invited feedback on draft legislation for a new regulatory framework for payment service providers. Sub-tranche (1a) covers core concepts underlying the new framework and proposed licensing obligations, with more parts of the framework to be covered in tranche 1b. Consultation closes 6 November 2025.

View Treasury WebsiteTreasury consults on next phase of payments reforms

Treasury has invited feedback on draft legislation for a new... -

22 September 2025

ASIC signals opportunity for industry to lift private credit standards

22 September 2025In its latest update on Australia’s public and private markets, ASIC has called on industry bodies to lift their standards across Australia’s private credit sector following expert observations on better and poorer practices.

View ASIC WebsiteASIC signals opportunity for industry to lift private credit standards

In its latest update on Australia’s public and private markets,... -

19 September 2025

ASIC issues DDO stop order against RELI Capital Mortgage

19 September 2025ASIC has made an interim stop order against the RELI Capital Mortgage Fund (Fund), a registered managed investment scheme operated by RELI Capital Limited (RELI Capital) to protect consumers and retail investors from acquiring a product that may not be suitable for their financial objectives, situation or needs.

ASIC’s action follows concerns that the target market in the Target Market Determination (TMD) for the Fund:

- the target market potentially includes investors who intend to hold the Fund as a ‘Core Component’ (25-75%) of their portfolio

- the Fund’s risk level ‘Risk level 3 (Low to Medium)” is an incomplete measure of the Fund’s risk

- the TMD states that the Fund is suitable for investors seeking capital preservation, and

- the TMD specifies that no distribution conditions are necessary for the Fund.

ASIC issues DDO stop order against RELI Capital Mortgage

ASIC has made an interim stop order against the RELI... -

18 September 2025

ASIC supports innovation through exemptions for distributors of Australian stablecoin

18 September 2025ASIC has announced an important step in facilitating growth and innovation in the digital assets and payments sectors.

ASIC has granted class relief for intermediaries engaging in the secondary distribution of a stablecoin issued by an Australian financial services (AFS) licensed issuer.

As and when more issuers of eligible stablecoins obtain an AFS licence, ASIC will consider extending the above relief to intermediaries distributing those stablecoins.

ASIC is committed to supporting responsible innovation in the rapidly evolving digital assets space, while ensuring important consumer protections are in place by having eligible stablecoins issued under an AFS licence.

View ASIC WebsiteASIC supports innovation through exemptions for distributors of Australian stablecoin

ASIC has announced an important step in facilitating growth and... -

18 September 2025

APRA and ASIC host Superannuation CEO Roundtable

18 September 2025APRA and ASIC hosted a joint Superannuation CEO Roundtable on 27 August 2025, attended by 10 superannuation trustee Chief Executive Officers (CEOs) that manage the majority of superannuation platform products.

View APRA WebsiteAPRA and ASIC host Superannuation CEO Roundtable

APRA and ASIC hosted a joint Superannuation CEO Roundtable on... -

18 September 2025

ASIC issues DDO stop orders against La Trobe Australian Credit Fund

18 September 2025ASIC has made interim stop orders against the 12 Month Term Account and 2 Year Account products offered under the La Trobe Australian Credit Fund (Fund), a registered managed investment scheme operated by La Trobe Financial Asset Management Limited (La Trobe) due to deficiencies in the target market determination (TMD) for both products.

View ASIC WebsiteASIC issues DDO stop orders against La Trobe Australian Credit Fund

ASIC has made interim stop orders against the 12 Month... -

15 September 2025

ANZ admits widespread misconduct and agrees to pay $240 million in penalties

15 September 2025Australia and New Zealand Banking Group Limited (ANZ) has admitted to engaging in unconscionable conduct in services it provided to the Australian Government, incorrectly reporting its bond trading data to the Australian Government by overstating the volumes by tens of billions of dollars and to widespread misconduct across products and services impacting nearly 65,000 customers.

ASIC and ANZ will ask the Federal Court to impose penalties of $240 million in relation to four separate proceedings spanning misconduct across ANZ’s Institutional and Retail divisions.

The misconduct occurred over many years and was marked by ANZ’s significant failure to manage non-financial risk across the bank.

View ASIC WebsiteANZ admits widespread misconduct and agrees to pay $240 million in penalties

Australia and New Zealand Banking Group Limited (ANZ) has admitted...