General Corporate Compliance Training

General Corporate Compliance

A simple enterprise-wide solution for a complex world of regulation.

Effective compliance training is learning that is engaging, relevant and meaningful for organisations and their employees.

Our Corporate Compliance modules are suitable for organisation wide training from front-line employees to management and leadership and directors.

- Licensees must comply with general obligations under various Acts, including the Corporations Act.

- All financial representatives must be trained to adhere to financial services-specific regulation and industry codes with respect to conduct.

Licensees are also required to be able to provide evidence to regulators that their representatives are adequately trained to perform their role on both an initial and ongoing basis.

(RG 104 AFS licensing: Meeting the general obligations, RG 205 Credit licensing: General conduct obligations).

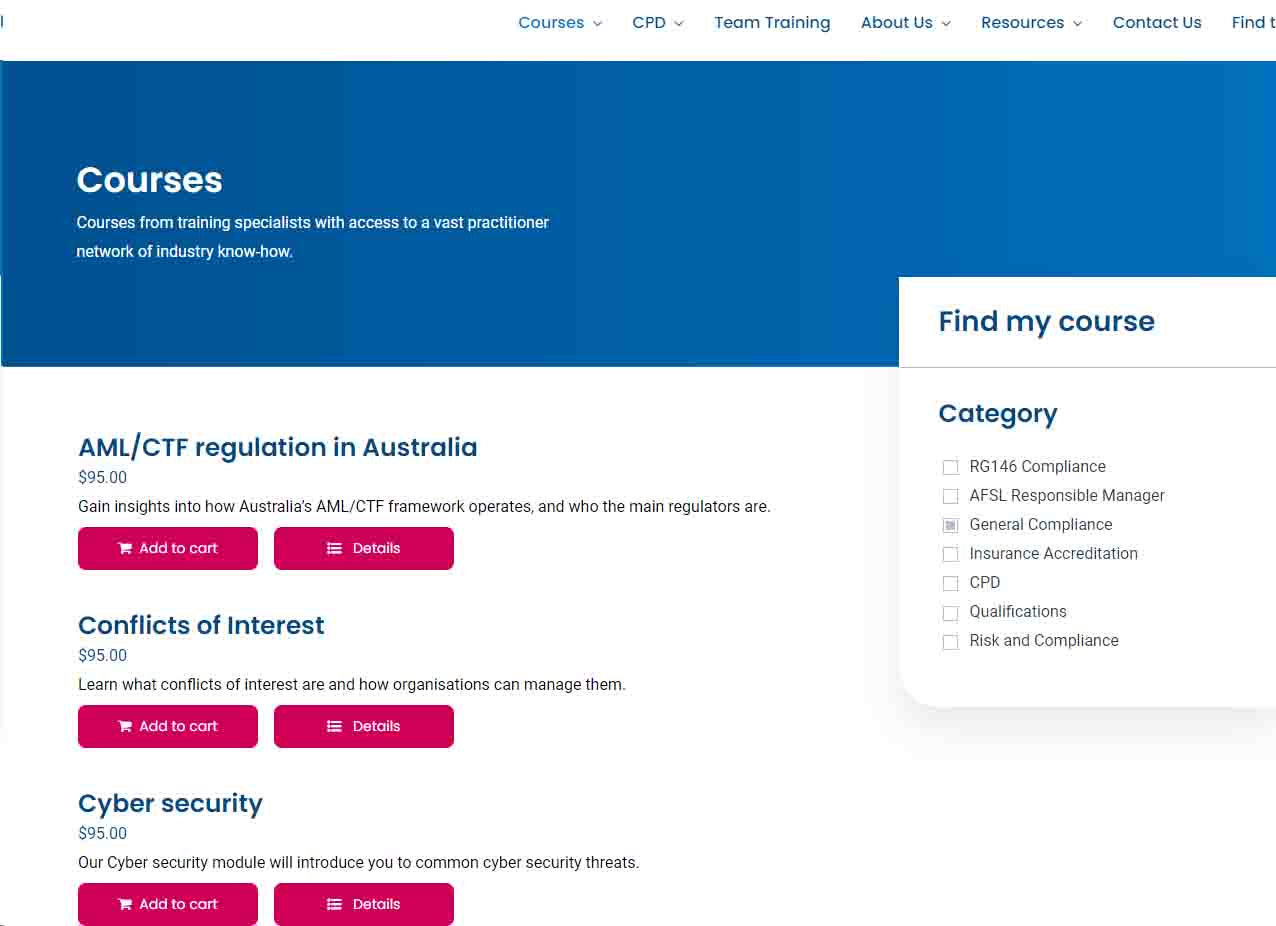

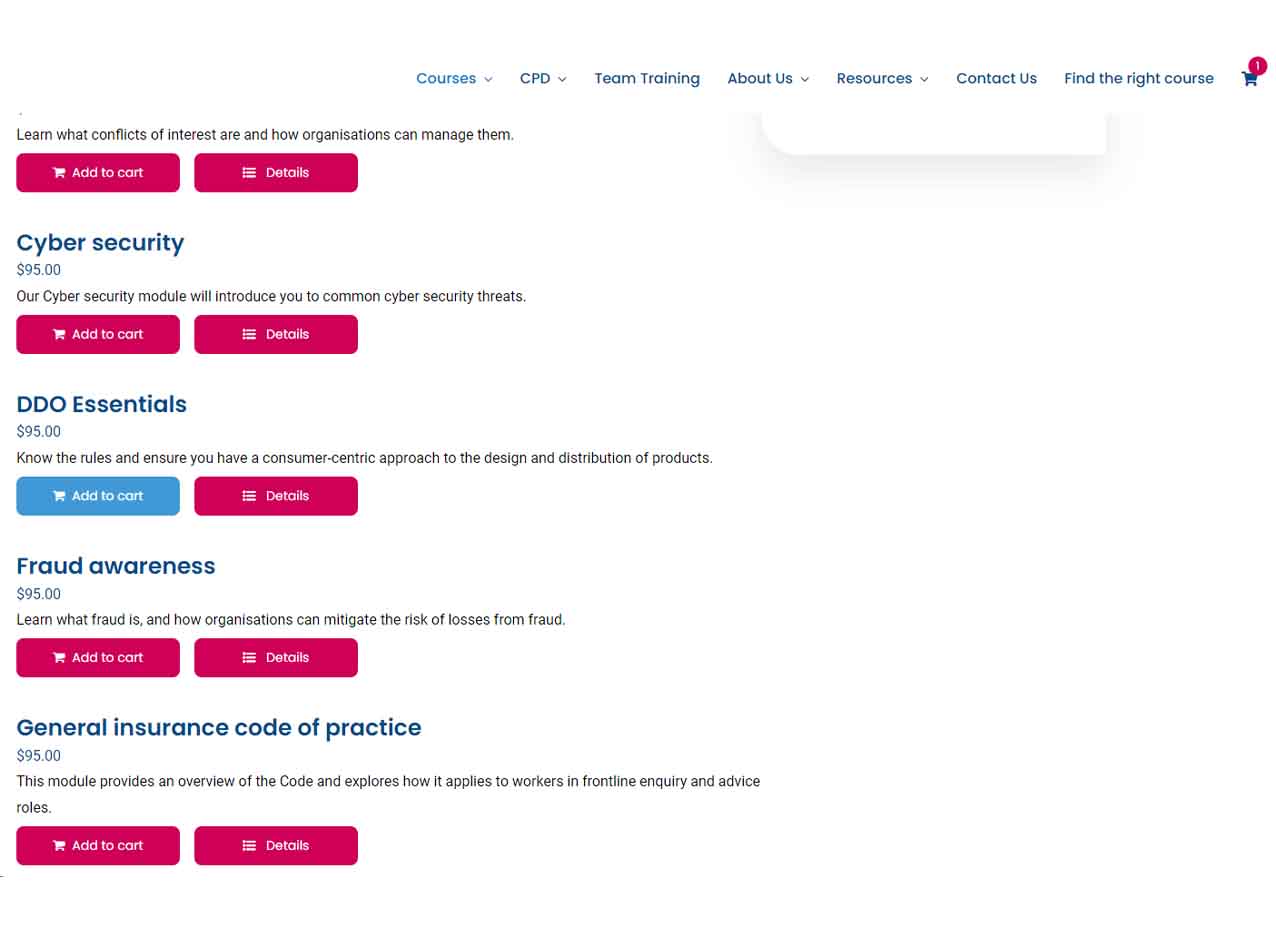

Tailor your learning journey

Select specific modules your team requires allowing you to focus on just the areas that matter most.

Effective, meaningful training

Engaging modules, helping learners to efficiently process, retain, and apply information.

Flexible delivery

Online via our LMS or SCORM files hosted on your LMS. Customisable to your organisation’s policies and procedures.

Fits easily into busy workdays

Each module is 30-45 mins. The perfect study duration, balancing convenience with learning.

Frequently Asked Questions

Corporate Solutions

Request a quote for your team.

OR

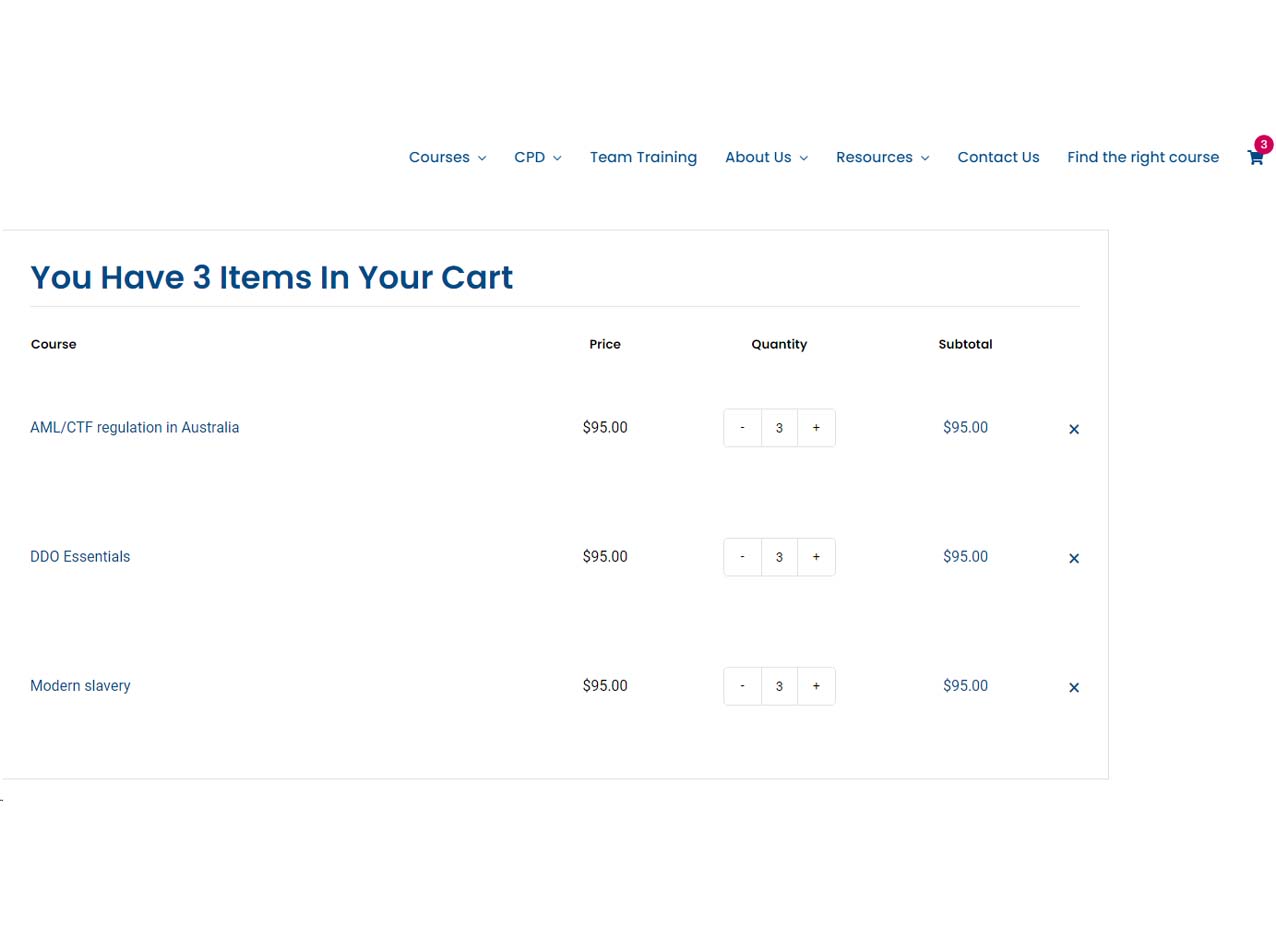

Purchase online: Three easy steps to get your team started.

- Visit our Shop Page and select General Compliance

- Select your courses to meet you and your team’s general obligations

- Add the required number of courses to your cart

We will request participants name and email. Once confirmed, we will enrol your team and they can begin their training.

Our general corporate compliance training contains a suite of engaging online modules designed to make employees aware of their responsibilities and feel empowered to uphold the conduct and regulatory standards applicable to their organisation.

A general compliance module – refers to a corporate e-learning course designed to meet specified organisational, legislative and/or conduct requirements.

The team at FEP understands that effective compliance training is not just about delivering regulatory content; it’s about creating learning that is engaging, relevant and impactful for organisations and their employees.

We design training experiences that resonate with individuals, ensuring they gain practical knowledge and skills that are immediately applicable to their roles.

Regulatory News

-

5 February 2026

APRA reduces liquidity add-on requirements for Macquarie Bank

5 February 2026The Australian Prudential Regulation Authority (APRA) has reduced liquidity add-on requirements imposed on Macquarie Bank Limited in 2021 and 2022.

APRA took action against Macquarie Bank following material breaches that revealed weaknesses in the bank’s liquidity risk controls and operational risk management.

In April 2021, APRA required Macquarie Bank to increase its Net Cash Outflow (NCO) overlay by 15 per cent in the Liquidity Coverage Ratio (LCR) calculation and reduce the Available Stable Funding (ASF) by 1 per cent for its Net Stable Funding Ratio (NSFR) calculation. APRA also agreed a remediation plan with the bank to address the identified weaknesses.

After further NCO calculation errors were identified, linked to control weaknesses, APRA increased the NCO overlay by an additional 10 per cent in April 2022, bringing the total overlay to 25 per cent.

Following a detailed supervisory assessment, including a Financial Accountability Regime attestation from Macquarie Bank outlining the progress of its remediation and independent assurance, APRA has now concluded that the bank has remediated aspects of liquidity risk management and reporting controls that affect the NCO and ASF calculations to a level that supports a partial removal of its liquidity add-on requirements. Consequently, the NCO add-on has been reduced to 15 per cent and the ASF adjustment has been removed. These changes take effect immediately.

The remaining NCO add-ons will remain in place until APRA confirms that all outstanding remediation activities are completed and effectively embedded. This is separate to the $500m operational risk capital overlay, which is subject to its own remediation activities and remains unchanged.

View APRA WebsiteAPRA reduces liquidity add-on requirements for Macquarie Bank

The Australian Prudential Regulation Authority (APRA) has reduced liquidity add-on... -

5 February 2026

Understand how criminals exploit online relationships and inflict heartache

5 February 2026In the lead-up to Valentine’s Day, the National Anti-Scam Centre has released its final quarter scams statistics, showing an increase in romance scams reports and losses across 2025. The data highlights the need for Australians to talk to family and friends about the tactics scammers use to build trust and steal money.

Romance scams remain one of the most financially and psychologically damaging financial crimes in Australia, with more than $28.6 million in financial losses reported to Scamwatch between January and December 2025. This represents a 21.8 per cent increase in losses experienced by 1,330 Australians. Scammers overwhelmingly contacted people through online methods, such as social media; dating platforms and online forums with online contact responsible for more than 80 per cent of financial losses.

ACCC Acting Chair Catriona Lowe said criminals use carefully rehearsed tactics designed to build trust quickly and shift conversations toward requests for money, gifts or personal information.

“Romance scammers operate all year round, but the lead up to Valentine’s Day is a good time to have a heart-to-heart with loved ones and build awareness of how these scams work so we can help people better protect themselves and others,” Ms Lowe said.

“Criminals exploit technology, trust, and emotion for financial gain. Reporting suspicious activity to Scamwatch and sharing what you know can stop them from causing further harm and protect others.”

People are encouraged to access resources on Scamwatch to provide support to loved ones who may be targeted by scammers, including red flag signs, conversation starters and the manipulation tactics deployed by scammers.

View sourceUnderstand how criminals exploit online relationships and inflict heartache

In the lead-up to Valentine’s Day, the National Anti-Scam Centre... -

5 February 2026

ASIC takes further steps to support Australians impacted by First Guardian and Shield collapse

5 February 2026ASIC is taking further steps to support thousands of Australians who invested in the Shield Master Fund (Shield) and First Guardian Master Fund (First Guardian), which have collapsed.

So far, less than 2,000 of around 11,000 Australians who invested approximately $1.1 billion in Shield and First Guardian have lodged complaints with the Australian Financial Complaints Authority (AFCA), prompting ASIC to take further action to ensure investors understand the impact.

From tomorrow (Friday 6 February 2026), ASIC will begin sending further information to investors, including a link to a dedicated consumer website that contains trusted and independent support, and options to make a complaint: takeyoursuperback.com.

The new consumer website has been independently developed by Super Consumers Australia with funding from ASIC. Super Consumers Australia is an independent consumer advocacy organisation that is helping consumers impacted by the collapse of First Guardian and Shield understand what they can do.

The website provides First Guardian and Shield investors with guidance and resources to help navigate next steps including:

- how to lodge a complaint with AFCA to seek compensation, including deadlines for submitting complaints

- how to access support services if they are experiencing financial hardship or need someone to talk to

Consumers should visit takeyoursuperback.com for further information and details on how they can make a complaint to AFCA.

To date, around 4,000 consumers have benefited from approximately $421 million in payments from Macquarie and compensation from Netwealth as part of court enforceable undertakings agreed to by ASIC as part of its investigations into Shield and First Guardian.

ASIC’s investigations into Shield and First Guardian continue. Nearly 50 people across ASIC are working across 26 investigations, which are among the largest and most complex cases in ASIC’s history.

View ASIC WebsiteASIC takes further steps to support Australians impacted by First Guardian and Shield collapse

ASIC is taking further steps to support thousands of Australians... -

5 February 2026

AUSTRAC has launched its program starter kits to assist tranche 2 entities

5 February 2026AUSTRAC has developed guidance for your industry to help you understand your obligations under anti-money laundering and counter-terrorism financing (AML/CTF) laws.

View sourceAUSTRAC has launched its program starter kits to assist tranche 2 entities

AUSTRAC has developed guidance for your industry to help you... -

4 February 2026

OAIC statement on Administrative Review Tribunal’s Bunnings decision

4 February 2026Today’s decision by the Administrative Review Tribunal relating to Bunnings Group Limited’s use of facial recognition technology (FRT) is an important reiteration of the key principles and protections contained in Australian privacy law.

The Tribunal affirmed the Privacy Commissioner’s finding that Bunnings contravened Australian Privacy Principles (APP) 1 (open and transparent management of personal information) and 5 (notification of the collection of personal information) when rolling out FRT in its stores.

The Tribunal found that Bunnings failed to provide appropriate notice to individuals of its use of FRT and should have completed a ‘formal, structured and documented’ risk assessment of its FRT system which considered the privacy implications.

The Tribunal also affirmed the Privacy Commissioner’s statement of the relevant factors when considering whether Bunnings was entitled to rely on an exemption to the requirement to obtain consent for the collection of personal information, namely whether the FRT was a suitable and effective response to the problem of repeat offenders, whether less privacy-intrusive alternatives were available, and whether the use of FRT was proportionate.

However, the Tribunal departed from the Privacy Commissioner’s ultimate finding that Bunnings had contravened APP 3.3 (collection of solicited personal information).

The Tribunal was satisfied that Bunnings was entitled to rely on exemptions to the requirement to obtain consent, for the limited purpose of combatting retail crime and protecting their staff and customers from violence, abuse and intimidation within their stores.

View sourceOAIC statement on Administrative Review Tribunal’s Bunnings decision

Today’s decision by the Administrative Review Tribunal relating to Bunnings... -

4 February 2026

Petra Capital fined for regulatory data reporting failures

4 February 2026Sydney-based stockbroking firm Petra Capital Pty Ltd (Petra Capital) has been fined $205,350 by the Markets Disciplinary Panel (MDP) for misreporting regulatory data on more than 3,600 occasions.

Following an ASIC investigation, the MDP found Petra Capital breached the market integrity rules by failing to provide accurate information, being a unique code used to identify clients executing orders or transactions.

Petra Capital’s inconsistent use of client reference information when reporting regulatory data led to one client appearing as multiple clients on 3,632 occasions. This was caused by a system update and affected 14,741 trades between 3 March 2022 and 5 December 2023.

The MDP considered Petra Capital to be ‘careless’ and found that it should have taken steps to ensure its reporting format complied with the law, including by proactively and periodically reviewing its systems and the underlying assumptions in its coding.

View ASIC WebsitePetra Capital fined for regulatory data reporting failures

Sydney-based stockbroking firm Petra Capital Pty Ltd (Petra Capital) has... -

4 February 2026

ASIC urges super trustees to step up and address serious gaps in anti-scam and fraud protections

4 February 2026ASIC is urging immediate action from superannuation trustees to strengthen anti-scam and fraud practices after its latest review exposed significant gaps in communications for members.

ASIC assessed scams and fraud-related website content across 47 superannuation funds, benchmarking them against comparable website content from the big four banks (ANZ, Commonwealth Bank, NAB, and Westpac).

The review focused on the availability, quality and actionability of anti-scams and fraud content, including by checking the website content for clarity and relevance, prominence on the website and readability. ASIC’s review found banks scored positively in over 80% of criteria assessed, whereas most super funds scored positively against just 40–60% of the same criteria.

ASIC Commissioner Simone Constant said despite being custodians of $4.3 trillion in Australian retirement savings, the superannuation industry has been slow to respond to evolving scams and fraud risks to members.

View ASIC WebsiteASIC urges super trustees to step up and address serious gaps in anti-scam and fraud protections

ASIC is urging immediate action from superannuation trustees to strengthen... -

4 February 2026

APRA publishes Margaret Cole’s remarks to the Conexus Chair Forum

4 February 2026The Australian Prudential Regulation Authority (APRA) has published remarks delivered this afternoon by APRA Deputy Chair Margaret Cole to the Conexus Chair Forum.

In her speech “Tales of the unexpected”, Ms Cole emphasises APRA’s resolute focus on lifting trustee standards across a range of areas including operational risk management, cyber controls and investment governance to build fund resilience and protect Australians’ retirement savings.

Her comments include:

- “When you look back at events in superannuation over the past few years, “expect the unexpected” would be an appropriate maxim for the industry. Too many trustees have been caught off guard by situations they did not expect or had not taken steps to prevent. In many cases, these were situations that might not have been anticipated but were not entirely unforeseeable either.”

- “Trustees should be especially vigilant about the cyber risk to assets sitting in retirement phase products. These products provide greater avenues for funds to be withdrawn from the superannuation system.”

- “Shortcomings in trustee governance of investment valuations, liquidity and platforms will continue to be a focus for APRA. Platform trustees, in particular, can expect continued heightened scrutiny this year.”

- “The imposition of licence conditions is a critical APRA tool. Licence conditions drive immediate attention and action to addressing deficiencies, typically without an extended period of court litigation. In my time at APRA, we have become more muscular in our use of this tool. You can expect this to continue.”

The full speech is available on the APRA website at: APRA Deputy Chair Margaret Cole’s remarks to the Conexus Chair Forum

View APRA WebsiteAPRA publishes Margaret Cole’s remarks to the Conexus Chair Forum

The Australian Prudential Regulation Authority (APRA) has published remarks delivered... -

3 February 2026

New ASIC Chair

3 February 2026ASIC Chair Joe Longo has welcomed the appointment of Sarah Court as the agency’s incoming Chair.

Mr Longo said Ms Court would bring deep regulatory expertise to the role from her career of public service.

‘Sarah is an exceptional regulator with a strong record in enforcement that demonstrates her integrity and impact,’ Mr Longo said.

‘Her work as ASIC’s Deputy Chair has been instrumental to the success of the agency’s structural transformation that has strengthened our enforcement posture and work, leading to better outcomes for consumers and a fairer financial system.

‘ASIC will be in very capable hands under her leadership.

‘Over the coming months, I will support Sarah, the Commission and all our staff to ensure a smooth and orderly transition.’

Sarah Court commences as ASIC Chair on 1 June 2026.

View ASIC Website -

30 January 2026

Federal Court orders Australian Unity Funds Management to pay $7 million penalty for failing to confirm product suitability for investors

30 January 2026The Federal Court has ordered Australian Unity Funds Management Limited (Australian Unity) to pay a $7.125 million pecuniary penalty for breaching design and distribution obligations (DDO) by failing to confirm the suitability of one of its products for retail investors.

As responsible entity of the Australian Unity Select Income Fund (Fund), Australian Unity admitted that it failed to take reasonable steps to ensure that interests in the Fund were only distributed to investors who matched the criteria outlined in its three Target Market Determinations (TMDs) for the Fund.

As a result, hundreds of retail investors were able to invest in the Fund even though the product may not have been suitable for them under those TMDs.

Australian Unity, also known as AUFM, admitted that it issued interests in the Fund to retail clients:

- on 89 occasions without requiring them to submit, as part of their application, a completed questionnaire with answers to questions to determine whether they were within the target market described in the Fund TMDs, and

- on 239 occasions without reviewing submitted questionnaires that had been completed by them to determine whether they were within the target market described in the Fund TMDs.

The Federal Court has ordered Australian Unity Funds Management Limited... -

29 January 2026

ASIC acts against 28 SMSF auditors, flags increased scrutiny on in-house audit breaches

29 January 202628 self-managed superannuation fund (SMSF) auditors had their registrations cancelled, conditions imposed on them, or were disqualified by ASIC in the first half of the 25-26 financial year.

SMSF auditors are responsible for providing assurance over the $1 trillion in retirement savings held in Australia’s 661,000 SMSF accounts. They must act as trusted gatekeepers who contribute to the integrity and confidence in the SMSF regime.

Between 1 July 2025 and 31 December 2025, ASIC:

- disqualified 4 SMSF auditors,

- imposed additional conditions on 2 SMSF auditors, and

- cancelled the registration of 22 SMSF auditors.

ASIC took this action after finding breaches of professional obligations and standards, including:

- failing to comply with auditing and assurance standards, independence and continuing professional development requirements or to hold professional indemnity insurance,

- failing to provide ASIC with annual statements,

- failing to advise ASIC of changes to their contact details on the public register of SMSF auditors and not responding to regulatory compliance requests, and

- failing to carry out enough audit work to meet the practical experience requirements.

Andy Choi, Robert Morey, Andrew Orphanides and Ermis Yianni were disqualified from being SMSF auditors.

John Couroyannis and Dawid Maj had additional conditions imposed on their SMSF auditor registrations. The specific conditions can be viewed by searching the SMSF auditor’s name in ASIC’s Professional Registers Search.

Of the 22 auditors who had their registrations cancelled, 9 were cancelled over a failure to perform any significant audit work during the last 5 years. These auditors were referred to ASIC by the ATO, further adding to the 11 auditors who had their registrations cancelled last year as part of the ATO’s ongoing project to identify auditors who fail to maintain the necessary practical experience. These auditors were Yvonne Ching, Patrick Hoey, Christopher Leech, Rochelle Massih, Barry Mendel, Rick Siew, Thien Siow, John Whiting and Weifeng Zhu.

Ahmed Afifi and Fredel Twum were cancelled for not updating their contact details on the public register and failing to respond to regulatory compliance requests.

The registrations of 11 SMSF auditors were cancelled by ASIC for failing to comply with their obligation to lodge multiple annual statements.

View ASIC WebsiteASIC acts against 28 SMSF auditors, flags increased scrutiny on in-house audit breaches

28 self-managed superannuation fund (SMSF) auditors had their registrations cancelled,... -

27 January 2026

ASIC Key issues outlook 2026

27 January 2026ASIC is tracking major shifts across Australia’s financial system as pressures on consumers, markets and businesses intensify.

In 2026, continued cost‑of‑living strains for vulnerable Australians, rising debt and ongoing geopolitical tensions are adding volatility and uncertainty. At the same time, rapid advances in AI are transforming financial services—and fuelling a surge in AI‑powered cybercrime that is testing the resilience of companies and undermining public trust in AI‑driven decisions.

Market structure is continuing to evolve, with private markets expanding and digitalisation accelerating. Meanwhile, changes to ASX governance requirements may reshape how listed companies operate, influencing transparency and market confidence.

Global regulatory settings are also diverging, creating growing fragmentation that makes compliance more complex and increases the risk of uneven consumer protections.

These system‑wide forces cut across all sectors ASIC regulates.

Highlighting the key issues for 2026 helps direct attention to where risks are most likely to emerge and underscores where ASIC is focused to safeguard trust, integrity and confidence in Australia’s financial system.

View ASIC WebsiteASIC is tracking major shifts across Australia’s financial system as... -

27 January 2026

Brendan Gunn pleads guilty to dealing with money reasonably suspected of being proceeds of crime

27 January 2026Former finance director Brendan Gunn of Brisbane, has pleaded guilty to dealing with more than $180,000 when it was reasonable to suspect that those funds were the proceeds of crime, derived from suspected international scams that targeted Australian investors.

At the time of offending, Mr Gunn was a director of Mormarkets Pty Ltd (Mormarkets), a company that accepted deposits from Australians for cryptocurrency and other supposed investment opportunities. While Mormarkets’ bank accounts were in operation, Mr Gunn was repeatedly notified of suspicious activity or reports of fraud, with the accounts progressively closed.

View ASIC WebsiteBrendan Gunn pleads guilty to dealing with money reasonably suspected of being proceeds of crime

Former finance director Brendan Gunn of Brisbane, has pleaded guilty... -

27 January 2026

BPS Financial to pay $14 million in penalties over crypto Qoin Wallet

27 January 2026The Federal Court has found BPS Financial Pty Ltd (BPS Financial) must pay $14 million in pecuniary penalties over its promotion and operation of its ‘Qoin Wallet’ crypto product.

BPS Financial promoted the Qoin Wallet as a non-cash payment facility linked to a digital crypto token called ‘Qoin’.

In 2024, the Federal Court found that BPS Financial engaged in unlicensed conduct over almost three years by issuing and providing financial advice about the Qoin Wallet without holding an Australian Financial Services License. The Court also found that BPS Financial engaged in misleading and deceptive conduct when it made several false and misleading representations about the Qoin Wallet.

In 2025, the Full Federal Court found that BPS Financial engaged in unlicensed conduct over an additional 10-month period because BPS could not rely on the ‘authorised representative’ exemption under the Corporations Act when issuing the Qoin Wallet.

View ASIC WebsiteBPS Financial to pay $14 million in penalties over crypto Qoin Wallet

The Federal Court has found BPS Financial Pty Ltd (BPS... -

23 January 2026

Fund manager sentenced to 6 years’ jail in $3 million Platinum Asset Management insider trading case

23 January 2026Former investment manager Rodney Forrest has been sentenced to 6 years’ imprisonment for insider trading and procuring others to trade in more than $3 million of Platinum Asset Management Limited (Platinum) shares (ASX: PTM).

In August 2024, Mr Forrest secretly accessed the computer of the Chairman of Regal Partners Limited (Regal) without permission and photographed confidential takeover documents (‘Pitch Deck’). He then traded and procured others to trade in Platinum shares before leaking details of the takeover to the media, making over $300,000 profit for himself.

The Federal Court in Sydney today sentenced Mr Forrest to five years imprisonment for insider trading and two years for procuring others to trade, with one year of the procuring offence to be served cumulatively with the insider trading offence. With a total sentence of six years and a non-parole period of three years, Mr Forrest will be eligible for parole on 22 January 2029.

His Honour Justice Bromwich’s sentence also took into account a further offence that Mr Forrest provided unlicensed financial services as an investment funds manager to two entities over a 9-month period.

This marks the first outcome for ASIC’s new specialist insider trading team which investigated and finalised the case within 16 months of the offending. The matter was prosecuted by the Office of the Director of Public Prosecutions (Cth) (CDPP).

View ASIC WebsiteFund manager sentenced to 6 years’ jail in $3 million Platinum Asset Management insider trading case

Former investment manager Rodney Forrest has been sentenced to 6... -

22 January 2026

AML/CTF transitional rules update

22 January 2026The Department of Home Affairs and AUSTRAC are working to finalise transitional rules to support a smooth implementation of the anti-money laundering and counter-terrorism financing (AML/CTF) reforms. The transitional rules will allow periods of time for reporting entities to adjust their business and processes to certain obligations, while still managing their ML/TF risk.

These transitional rules will ensure the reforms work effectively in practice and will allow additional time for certain reporting entities to develop systems and processes and to meet certain new obligations.

The transitional rules are made by the Minister for Home Affairs under Schedule 12 of the Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024. They are distinct from the Anti-Money Laundering and Counter-Terrorism Financing Rules 2025 made by the AUSTRAC CEO and also separate from any further amendments to the Anti-Money Laundering and Counter-Terrorism Financing Rules 2025 that may be made by AUSTRAC.

Over the coming weeks the Department of Home Affairs will publish an exposure draft of the transitional rules. Industry will have an opportunity to provide feedback at this stage.

View sourceAML/CTF transitional rules update

The Department of Home Affairs and AUSTRAC are working to... -

22 January 2026

AUSTRAC orders audit of Airwallex for suspected AML/CTF compliance failures

22 January 2026AUSTRAC has ordered the appointment of an external auditor to assess whether payment platform, Airwallex Designated Business Group (Airwallex DBG), is meeting its anti-money laundering and counter-terrorism financing (AML/CTF) obligations, following concerns about potential non-compliance.

AUSTRAC Chief Executive Officer, Brendan Thomas, said external audits are a critical regulatory tool to assess serious compliance concerns and to protect the financial system from criminal exploitation.

“We take this action where we suspect serious non-compliance, because we expect businesses to be actively managing their AML/CTF obligations,” Mr Thomas said.

“Strong compliance systems and timely reporting of suspicious activity are essential to disrupting criminal activities and illicit proceeds of crime generated from fraud, scams, illicit tobacco, drug trafficking and payments relating to crimes such as child sexual exploitation.”

“As a global payment platform that facilitates the transfer of funds to multiple jurisdictions, AUSTRAC is concerned with Airwallex’s transaction monitoring program has not been attuned to the full range of risks it faces and that the company hasn’t demonstrated an acceptable understanding of who its customers are and what reporting may be required.

“Our concerns also extend to how well Airwallex identifies and reports on suspicious matters and the effective oversight of these important obligations.”

The auditor, appointed under section 162 of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, will examine whether the business is complying with key AML/CTF requirements including:

- maintaining an AML/CTF program and complying with that program

- operating an ongoing customer due diligence program

- meeting suspicious matter reporting obligations.

The auditor must report their findings to AUSTRAC within 180 days of appointment. The scope of the audit is determined by AUSTRAC and will be conducted at Airwallex DBG’s expense.

The outcomes of the audit will assist Airwallex DBG to comply with anti-money laundering and counter-terrorism financing obligations and inform AUSTRAC whether any further regulatory action is required.

View sourceAUSTRAC orders audit of Airwallex for suspected AML/CTF compliance failures

AUSTRAC has ordered the appointment of an external auditor to... -

22 January 2026

APRA monitors in1Bank return of deposits

22 January 2026The Australian Prudential Regulation Authority (APRA) notes today’s announcement by in1Bank Limited (in1Bank) that it intends to return all funds to depositors and relinquish its licence to operate as an authorised deposit-taking institution (ADI).

The decision to relinquish its ADI licence has been taken by in1Bank.

APRA will monitor the return of all deposits to in1Bank depositors in an orderly and timely manner. During the return of deposit process, in1Bank’s depositors remain protected by the Financial Claims Scheme (FCS).

Customers with questions about deposits or accounts should contact in1Bank directly.

View APRA WebsiteAPRA monitors in1Bank return of deposits

The Australian Prudential Regulation Authority (APRA) notes today’s announcement by in1Bank Limited... -

21 January 2026

Australian Information Commissioner highlights improved transparency and integrity for government agencies in automated decision-making

21 January 2026The Office of the Australian Information Commissioner (OAIC) has identified opportunities for Australian Government agencies to improve transparency in the use of automated decision-making (ADM). ADM refers to the use of technology to automate decision-making processes. It is used across government in areas such as social services, taxation, aged care and veterans’ entitlements.

Australian Information Commissioner, Elizabeth Tydd said “Information about decision-making and the exercise of agencies functions is important information for the Australian community. It improves integrity, accountability and trust. The Information Publication Scheme (IPS) requires this type of information to be available to the public. The intended benefit of this Report is to inject clarity and certainty for agencies and the community regarding the operation of the Australian access to information scheme in the context of digital government.”

The OAIC’s latest Report, Automated decision-making and public reporting under the Freedom of Information Act, follows a desktop review conducted in October 2025 of the websites of 23 government agencies authorised to use ADM. The review assessed how agencies disclose their use of ADM as ‘operational information’ required to be published under the Freedom of Information Act 1982 (FOI Act). The Report acknowledges that technology has altered the operating environment of agencies and greater guidance is required to ensure that agencies are well placed to meet their existing obligations.

Australian Information Commissioner, Elizabeth Tydd said “The OAIC will begin consultation to update the Information Commissioner Guidelines as a priority in 2026.”

The Report highlights good practice but also opportunities for improvement for agencies to meet their obligations under the FOI Act to proactively publish information through the IPS. The Report also highlights the positive impact existing IPS obligations have in ensuring that transparency and accountability of actions and decisions are improved in the Australian Public Service under the Commonwealth Integrity Strategy– external site .

View sourceThe Office of the Australian Information Commissioner (OAIC) has identified... -

21 January 2026

ASIC Symposium: The Asia Pacific opportunity – Innovating for growth

21 January 2026Wednesday 4 March 2026 | 2.00 pm – 7.00 pm | International Convention Centre Sydney

From quantum computing and AI to tokenisation, technology is reshaping markets. Asia Pacific is home to dynamic, digitally native markets and proactive cross border collaboration.

Join us for a discussion on the role regulation will play in promoting innovation and what it takes to safeguard stability amid rapid disruption.

Regulators, market leaders and innovators will unpack the opportunities, risks and policy responses that will define the next decade. Be part of the conversation setting the pace for resilient, fair and efficient markets.

Coinciding with ASIC’s 35th anniversary, the Symposium is a milestone opportunity to reflect on developments in financial services.

View ASIC WebsiteASIC Symposium: The Asia Pacific opportunity – Innovating for growth

Wednesday 4 March 2026 | 2.00 pm – 7.00 pm | International...